Options are a form of derivative contract that gives buyers of the contracts (the option holders) the right (but not the obligation) to buy or sell a security at a chosen price at some point in the future. Option buyers are charged an amount called a premium by the sellers for such a right. Should market prices be unfavorable for option holders, they will let the option expire worthless and not exercise this right, ensuring that potential losses are not higher than the premium. On the other hand, if the market moves in the direction that makes this right more valuable, it makes use of it.

Options are generally divided into "call" and "put" contracts. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called exercise price or strike price. With a put option, the buyer acquires the right to sell the underlying asset in the future at the predetermined price.

Let's take a look at some basic strategies that a beginner investor can use with calls or puts to limit their risk. The first two involve using options to place a direction bet with a limited downside if the bet goes wrong. The others involve hedging strategies laid on top of existing positions.

KEY TAKEAWAYS

Options trading may sound risky or complex for beginner investors, and so they often stay away.

Some basic strategies using options, however, can help a novice investor protect their downside and hedge market risk.

Here we look at four such strategies: long calls, long puts, covered calls, protective puts, and straddles.

Options trading can be complex, so be sure to understand the risks and rewards involved before diving in.

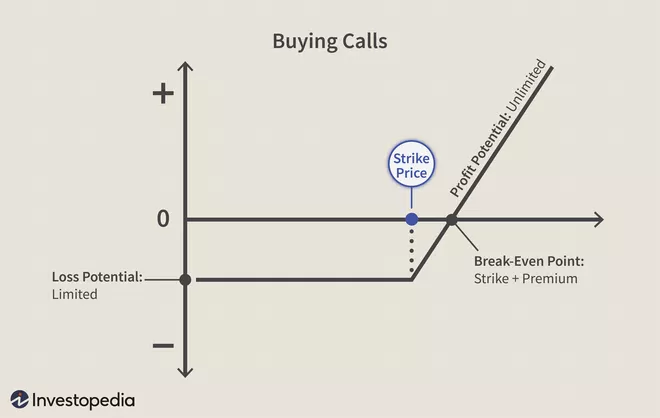

Buying Calls (Long Calls)

There are some advantages to trading options for those looking to make a directional bet in the market. If you think the price of an asset will rise, you can buy a call option using less capital than the asset itself. At the same time, if the price instead falls, your losses are limited to the premium paid for the options and no more. This could be a preferred strategy for traders who:

Are "bullish" or confident about a particular stock, exchange-traded fund (ETF), or index fund and want to limit risk

Want to utilize leverage to take advantage of rising prices

Options are essentially leveraged instruments in that they allow traders to amplify the potential upside benefit by using smaller amounts than would otherwise be required if trading the underlying asset itself. So, instead of laying out $10,000 to buy 100 shares of a $100 stock, you could hypothetically spend, say, $2,000 on a call contract with a strike price 10% higher than the current market price.

A standard equity option contract on a stock controls 100 shares of the underlying security.

Example

Suppose a trader wants to invest $5,000 in Apple (AAPL), trading at around $165 per share. With this amount, they can purchase 30 shares for $4,950. Suppose then that the price of the stock increases by 10% to $181.50 over the next month. Ignoring any brokerage commission or transaction fees, the trader’s portfolio will rise to $5,445, leaving the trader with a net dollar return of $495, or 10% on the capital invested.

Now, let's say a call option on the stock with a strike price of $165 that expires about a month from now costs $5.50 per share or $550 per contract. Given the trader's available investment budget, they can buy nine options for a cost of $4,950. Because the option contract controls 100 shares, the trader is effectively making a deal on 900 shares. If the stock price increases 10% to $181.50 at expiration, the option will expire in the money (ITM) and be worth $16.50 per share (for a $181.50 to $165 strike), or $14,850 on 900 shares. That's a net dollar return of $9,990, or 200% on the capital invested, a much larger return compared to trading the underlying asset directly.

Risk/Reward

The trader's potential loss from a long call is limited to the premium paid. Potential profit is unlimited because the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go